- Today's focus is on the release of crucial US inflation data, which is expected to show a decline in both the headline consumer price index and the core CPI.

- Market expectations include a decline in annual core CPI from 3.9% to 3.7% and a decline in annual CPI from 3.4% to 2.9%.

- In this article, we will analyze market scenarios in case disappointing or better than expected data is released.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock picking tool. Learn more here>>

Today sees the release of the most crucial event of the week: the US inflation data report.

According to Investing.com's economic calendar estimates, both the headline and global levels are expected to show an annual decline.

On a monthly basis, markets do not foresee significant changes.

Specifically, these are the expectations:

- Annual underlying CPI from 3.9% to 3.7%

- Annual CPI: 3.4% to 2.9%

- Monthly: unchanged at 0.3%

- Monthly: decrease from 0.3% to 0.2%

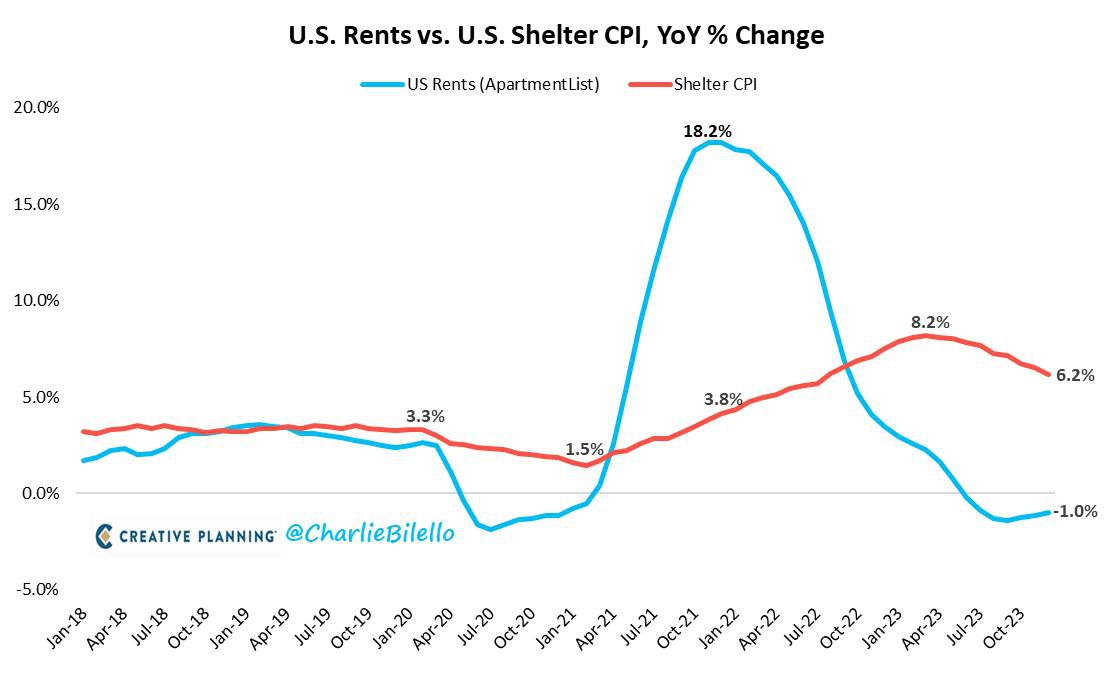

The housing component, specifically the shelter component, remains an important question. It is a “lagged” component that, as shown in the image below, has been trending downward for some time.

And since the Housing component weighs around 33 percent of the total CPI, then we can well understand how important it is for the downward trend that inflation continues to decline steadily.

Given the recent developments in the real estate and housing markets, all eyes will be on this specific part of today's reading.

How to read the report

Investors should watch the bond market as the main thermometer of the general reaction to the numbers.

This is because markets will price in the Federal Reserve's first rate cut in light of today's numbers. Remember that the bond market is much larger than the stock market and is often the main driver of investor sentiment.

If the inflation figure is lower than expected, the central bank could reconsider its stance on the first rate cut, which could lead to further gains in the market.

Therefore, higher yields would imply that the market will continue to expect a higher cost of capital for longer. Conversely, a drop in yields would imply that the Fed's pivot is ready to begin.

In case of good figures (reducing inflation), interesting opportunities may arise in asset classes that have suffered recently, namely:

- Lowercase letters

- Precious metals

- Captivity

On the contrary, a higher than expected CPI indicates that the work of the Federal Reserve may still have room for maneuver. In this case, the asset classes that are likely to benefit are:

- The U.S. dollar

- Foreign markets with lower expected real rates

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors around the world are already far ahead when it comes to AI-powered investing, using, customizing and developing it extensively to increase their returns and minimize losses.

Now, InvestingPro users can do the same from the comfort of their homes with our new flagship AI-powered stock picking tool: ProPicks.

With our six strategies, including the flagship “Tech Titans”, which outperformed the market by a whopping 1,183% over the last decade, investors have the best selection of stocks on the market at their fingertips each month.

Subscribe here and never miss a bull market again!

Subscribe today!

Don't forget your free gift! Use coupon code pro2it2024 at checkout to claim an additional 10% off Pro Annual and Yearly plans.

Disclaimer: This article is written for informational purposes only; does not constitute a solicitation, offer, advice, advice or recommendation to invest as such and is not intended to encourage the purchase of assets in any way. I would like to remind you that any type of asset is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains in the hands of the investor.