The S&P 500 continued higher on Friday, with only two decent selling attempts — first after the revised CPI rise, then in the first half of the regular session. The position remains bullish, regardless of the heavily contested breadth – however, I don't expect this steady pace of gains to continue through Tuesday's CPI, as the revision actually raises the disinflation bar a bit, but it would still be passed. Still, strong earnings, sales and labor market sentiment are fundamentally driving this rally as much as recessionists throwing in the towel.

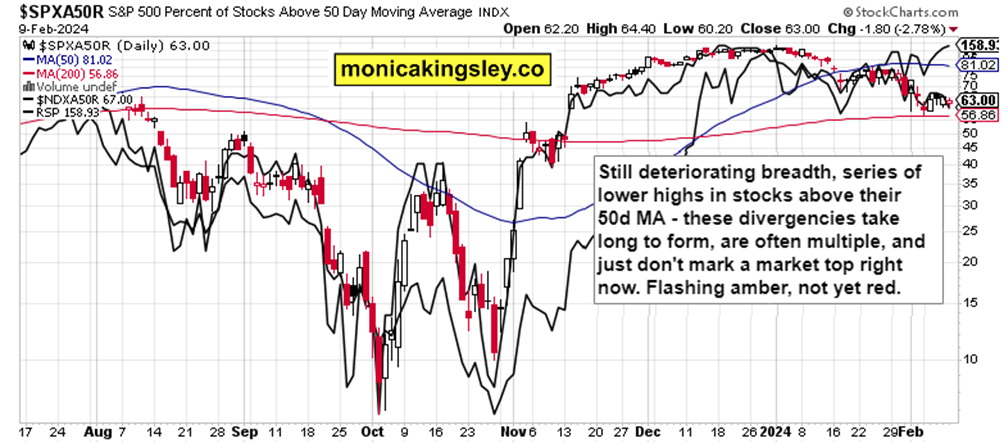

For all the P/E ratios that often come up with respect to the tech space, I'd say it was worse last year when NVDA was objectively more expensive relative to earnings or sales, which is why I'm calling as early as November to beat it . $500 later. It's true that market breadth was much better in November-December than it is now, but these differences are known to take a long time to resolve – and we're not at the top yet. The narrower the advance, the greater the danger.

Earnings aren't crushing economic growth yet and there's plenty that are doing well outside of the two strongest (MSFT and NVDA) – I've been bullish on discretionary coverage recently when I listed AMZN as the best in the sector last year and the higher your disposable income , the better off those retailers are (and I don't just mean LULU, which is relatively lagging behind if you're researching niche retailers).

Also look at financials and industrials, which I've also spoken favorably about in recent months – and add in the awakening materials, which corresponds to a subtle recovery in the manufacturing sector (PMI), and it's easy to see what this means for risk-taking and asset prices. generally medium term.

At one point the growing returns and recognition that Fed doesn't want to cut too soon, still would force a serious decline in stocks (valuations that are a function of liquidity – if in doubt look at bitcoin and miners to see we're still risking) – most probably around March FOMC and that would rhyme with rising USD supporting gold, silver and commodities until then still under control. For now, copper projects a picture of low inflation, continued disinflation – and Tuesday's CPI, whether core or headline, would be no different.

If you remember Friday's key points, you will come to the conclusion that it is not yet a mania:

(…) But throughout 2024 I was clear that the peak is not in, and that the grind is higher in stocks is to continue regardless of what rate cut expectations and actual revenue path would be. Japan's monetary policy normalization is about two months away, more stimulus for China would hit before then, and the Treasury is all too happy to take its foot off the pedal on long-term debt issuance — all bullish factors behind stocks. market progress as well as earnings, good earnings… making participants put aside the conundrum of soft landing vs. no landing aside and they were raising share prices.

I have served up many opportunities and ideas to clients on how to get the most out of the reserve by picking sectors or stocks that must outperform, and I've been able to do it – quoting yesterday's article (how did you like ARM's move? Just yesterday I increased this stock because AI has resulted in various takers, with NVDA currently struggling at $700 after I asked her in the fall to easily break $500…

Big picture recap

Time to recall the big picture and recent successes – we got a daily MSFT cut on earnings after the S&P 500 fell on a somewhat divisive FOMC, then continued confirmation of strong consumer sentiment via a solid XLY still outperforming AMZN, except for XLF and XLI doing well, you have a turn in healthcare (last year I favored LLY over JNJ – I was already talking about LLY in late 2022 due to their rich product offering coming).

Non-agricultural wages brought you another stellar success, both swing and intraday, and the strength of the Russell 2000 is great if you factor in (pick) regional bank issues (even Janet talked about them, and I called this point a key candidate that will force Powell's hand to cut early , if necessary) and XLRE a bit on the edge, smallcaps are still doing great. This is not an environment where reversals are born, nor is it 1999-style mania – it's still an orderly medium-term move higher against the backdrop of still slowly rising yields. You can take advantage as clients did and are doing both in ES and DAX intraday…

Let's jump right into the charts – today's complete article features 5 of them, including the S&P 500, yields, precious metals and oil.

Tired of seeing those red boxes instead of much more valuable information? Try premium services based on what and how you trade.

S&P 500 and Nasdaq

A graphic warning sign that is more likely to force a correction than a peak that would not be broken. That peak would be passed, but the air gradually gets thinner.

Credit markets

Yields haven't peaked yet and enthusiasm for rate cuts is not yet dialed up enough in my opinion. A path higher would start to raise doubts about a soft landing, but we're not there yet.