Key takeaways

- The S&P 500 fell less than 0.1% on Monday, February 12, 2024, remaining relatively stable ahead of Tuesday's Consumer Price Index (CPI) report.

- Shares of Motorola Solutions fell after the communications equipment company issued a lower-than-expected 2024 profit forecast.

- Shares of VF Corp. soared following reports that the family that founded the clothing conglomerate would support the efforts of activist investor Engaged Capital.

Major US stock indexes opened the week with mixed results, with Tuesday's release of Consumer Price Index (CPI) data and other corporate earnings reports on the horizon.

The S&P 500 fell 0.1%, failing to build on Friday's record close but remaining above the all-time high of 5,000. With a gain of 0.3%, the Dow Jones managed to reach a new all-time high. Meanwhile, the Nasdaq closed the session down 0.3%.

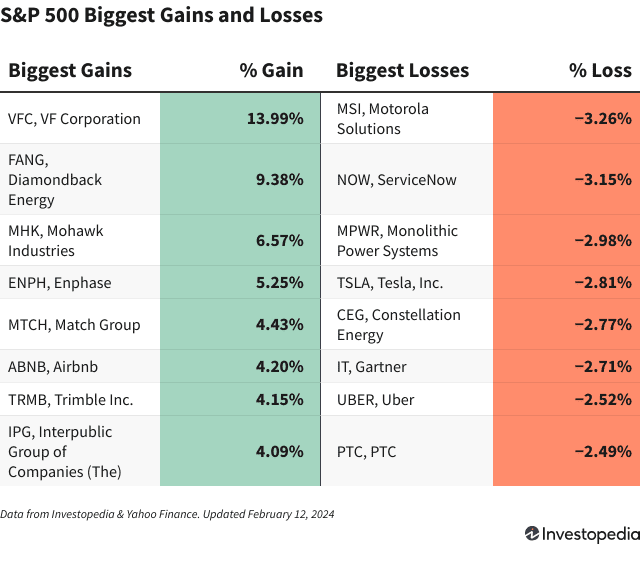

Motorola Solutions (MSI) shares fell 3.3%, marking Monday's weakest performance in the S&P 500. Even though last week's earnings report showed better-than-expected sales and profits for the fourth quarter, the telecom equipment supplier's adjusted earnings guidance for 2024 arrived. below expectations.

After opening the day higher, shares of enterprise cloud computing company ServiceNow (NOW) closed the session with a loss of 3.2%. Although shares have gained more than 14% so far in 2024 amid enthusiasm for ServiceNow's potential to help businesses automate their operations and improve sales, recent reports have shown that company insiders are getting rid of the shares.

Shares of Monolithic Power Systems (MPWR) fell 3.0%, reversing some of the huge gains posted late last week after the power management device provider reported strong quarterly results and issued an upbeat forecast for 2024. Analysts suggested that the recent advances in the share price may not be aligned with the company's earnings trajectory.

VF Corp. (VFC) led S&P 500 stocks following reports that activist investor Engaged Capital had gained support from the clothing firm's founding family to implement changes. Shares of the company, which owns Vans, The North Face and other clothing brands, soared 14.0%.

Diamondback Energy (FANG) shares rose 9.4% after the oil and gas company announced plans to merge with Endeavor Energy Resources in a deal worth $26 billion. The deal, the latest in a series of activities in the energy sector, would expand the company's position in the Permian Basin, the largest producing oil field in the US.

Mohawk Industries (MHK) shares rose 6.6% after the flooring maker's full-year earnings per share (EPS) for 2023 beat expectations, benefiting from lower input costs and measures to improve productivity . Analysts at Deutsche Bank upgraded Mohawk shares to Buy and raised their price target to $152, citing the potential for greater efficiency to drive additional earnings growth.