The focus is on the US CPI figures.

At last week's meeting, the Federal Reserve appeared less hawkish than expected, with Chairman Powell ruling out rate hikes and hinting that they are still leaning toward cuts. The weaker-than-expected April jobs report corroborated that view, which was shared by more policymakers this week.

The only official to express a different opinion was Minneapolis Federal Reserve President Neel Kashkari, who said interest rates may need to remain at current levels throughout the year and that the bar for a rate increase, although quite high, it is not infinite.

With all this in mind, next week traders will turn their attention to the US CPI for April, which will be released on Wednesday. According to S&P Global PMIs, producer prices rose again at a solid but slower pace during April compared to March, suggesting that risks surrounding Wednesday's numbers may be titled somewhat to the downside. In addition to that, the year-on-year variation in oil prices decreased and approached zero, adding to the downside risks of the general rate.

Therefore, if the data suggests that the latest consumer price tightness was only temporary and that inflation has started to cool again, traders could reduce their implied path a little further, which could be negative for yields. Treasury bonds and the US dollar.

That said, market participants could get an earlier idea of where inflation is headed in April on Tuesday, when the month's PPIs are scheduled to be released. US Retail Sales are also released at the same time as the CPI numbers, and could also affect the market's outlook on where the Federal Reserve is headed.

Will UK jobs data seal the deal for a Bank of England cut in summer?The Bank of England (BoE) appeared more dovish than expected yesterday, leaving interest rates unchanged but with two members voting in favor of a 25 basis point cut. The statement accompanying the decision added that they will consider upcoming data releases and how these inform the assessment that inflation risks are declining.

Combined with downward revisions to inflation projections, this suggests officials believe inflation will continue to weaken. The pound fell slightly at press time as investors became more convinced that the first 25 basis point reduction would occur in August.

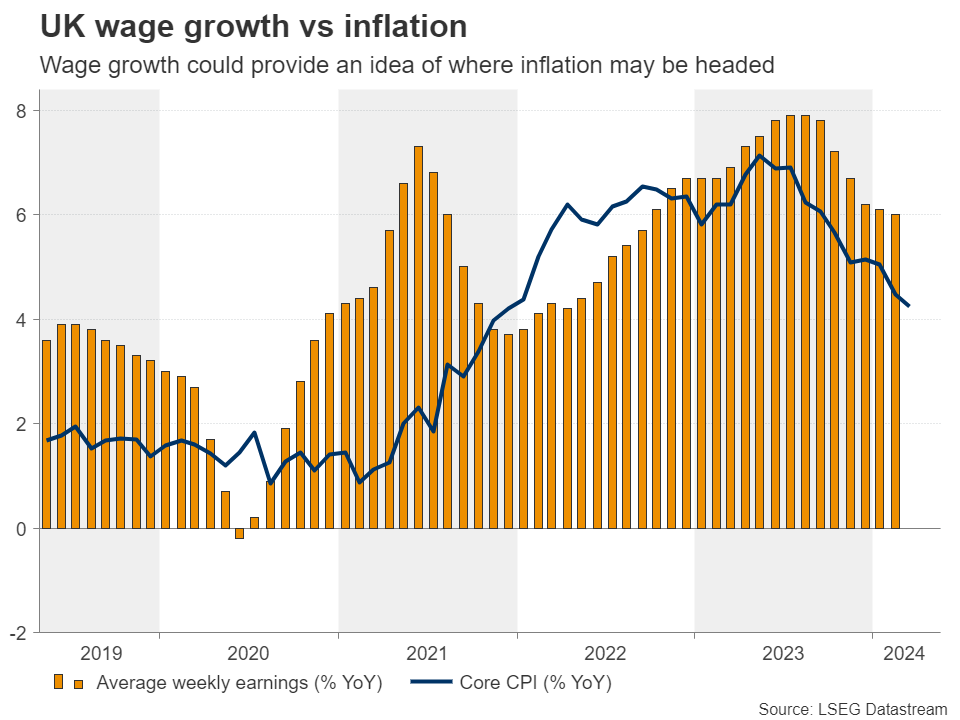

On Tuesday, the UK releases March employment data, where investors can pay close attention to wage growth to see if it softens further, something that may allow inflation to slow as the Bank has projected. Therefore, if wages slow, the pound could extend its Bank of England-related decline as traders could begin to examine whether a cut in June is a better option.

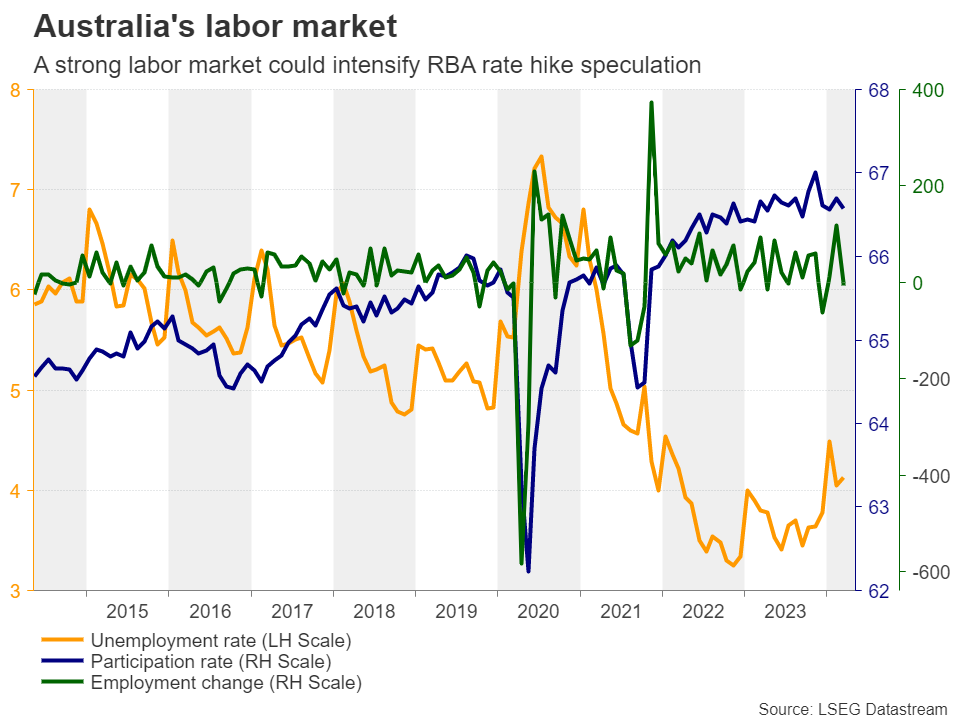

Australian dollar may benefit from increased RBA bullish betsAfter being disappointed by the RBA's decision to maintain a neutral stance, traders will now turn their attention to the Australian Wage Price Index on Wednesday and the country's employment report on Thursday.

Since inflation turned out to be tougher than expected in the first quarter, they no longer expect rate cuts from the RBA. Instead, they assign a decent 20% probability to a quarter-point increase for September.

Although the Bank reiterated that they are “not ruling out anything in or out” in this week's decision, a further acceleration in wages, which have been on an upward trend since the third quarter of 2020, and a strong rebound in employment could well increase the likelihood of a September hike at a time when other central banks are thinking about when to start lowering rates. This could prove positive for the Australian dollar, which could also benefit from further improvement in risk appetite if Wednesday's US inflation data encourages investors to increase their Fed rate cut bets. .

How did the Chinese economy start the second quarter?Speaking of the Australian dollar and general market sentiment, another variable in this equation next week will be China. On Friday, the world's second-largest economy will release its industrial production, retail sales and fixed asset investment data for April.

The country's official PMIs showed growth slowed in both the manufacturing and services sectors, suggesting activity cooled at the start of the second quarter after sizeable gains in March. However, China's exports and imports grew in April after contracting in March, pointing to improving domestic and external demand.

All that said, although strong GDP growth in the first quarter reduced the need for Chinese authorities to urgently increase stimulus measures, if next week's data adds to the notion of a slow start to the second quarter, the Concerns about the stability of the economic recovery may increase. re-emerge. This may weigh on the Australian dollar and the Australian dollar as the former will give back some of the employment-related gains.

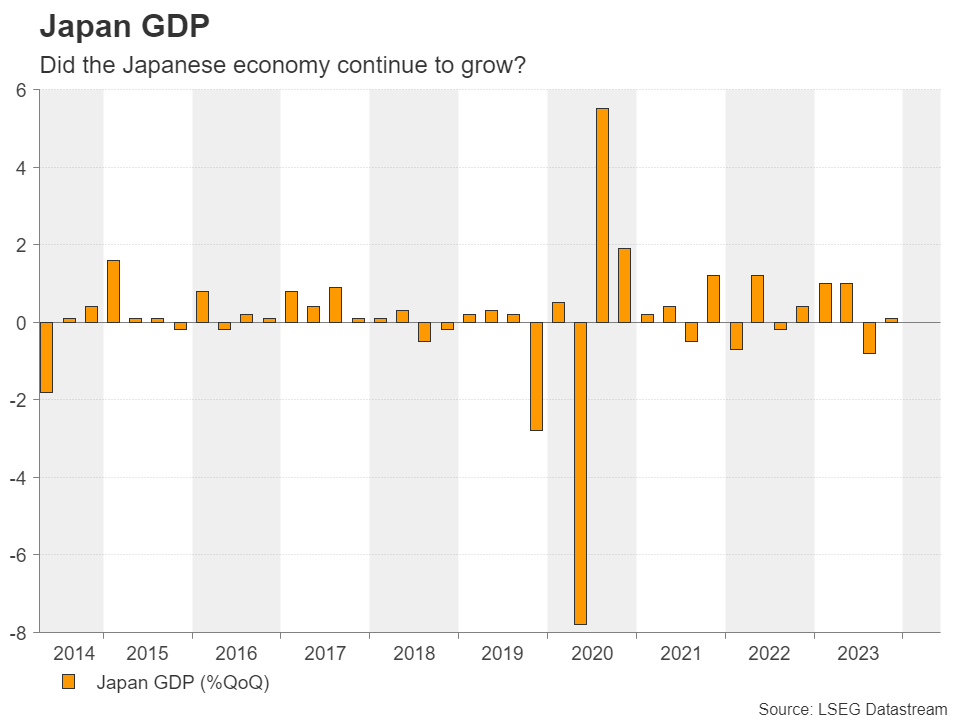

Japan's GDP is also in sightOn Thursday, during the Asian morning, Japan will publish the first estimate of its GDP for the first quarter, and it will be interesting to see if the economy continues to grow or if it falls back into contraction. If the latter is the case, the yen is likely to continue falling and approach the 160 per dollar area that triggered last week's first round of intervention.

However, even if Japanese authorities intervene again near that zone, a trend reversal would still be unlikely as another quarter of contraction could lead to speculation that the BoJ's next hike would be further delayed. For the yen to make a decent recovery, GDP data may need to reveal accelerated growth, encouraging market participants to increase their bullish bets in the summer.

Remove ads

.

!function(f,b,e,v,n,t,s){if(f.fbq)return;n=f.fbq=function(){n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments)};if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;n.queue=[];t=b.createElement(e);t.async=!0;t.src=v;s=b.getElementsByTagName(e)[0];s.parentNode.insertBefore(t,s)}(window, document,’script’,’

Source Link